how it works

are you a first time customer?

It takes around 5 minutes to apply. We’ll need your personal details like home address, an email address, mobile phone number and your employment details. Be sure to keep your phone handy to speed things up as we may contract you during the process.

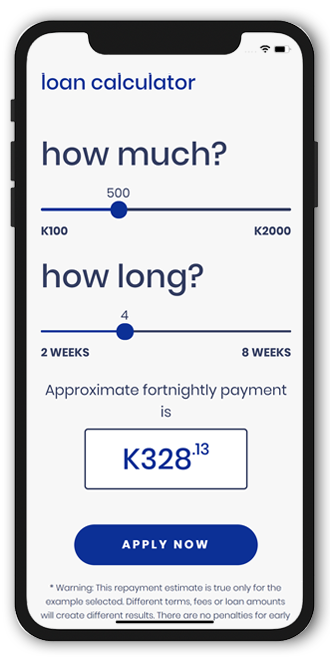

how you determine your loan amount

Using the sliders, work out how much you want to borrow, when you can pay it back and we’ll tell you the number and your approximate repayment amounts on the very first page.

how you sign your loan documents

We receive your loan application, make an assessment based on your supporting documents, and produce a loan agreement. Simple as that

do I qualify?

- Over 18

- Citizen, resident or hold a valid working visa

- Not be bankrupt

- Receive ongoing income

- Have an active bank account your pay goes into on regular paydays

- Must own an active cell phone

- Complete application

- Pass our employer checks

*additional criteria may apply

how to apply

design your loan

borrow from K100 -K2000 from as little as 7 days to 12 weeks

apply online

It takes about 5 minutes to apply online. Once you’ve applied we’ll begin to process your application and we’ll be in touch. You can still submit an application in person if you like. Call or email us for any help.

receive a cash deposit

Once your loan is approved you’ll need to sign your loan agreement. Cash is then transferred directly to your bank account – it’s often available in as little as 24-48 hours

repayments

We’ll set up repayments to automatically deduct on your payday so you don’t have to worry about missing repayments. You’re all set. We’ll remind you when your loan is complete

warning about borrowing

Moni Market specialises in providing fast little loans. You can borrow K100 to K2000 for between 2 and 12 weeks.

When you get a loan with Moni Market, you know exactly what you are getting. We promise there are no hidden costs, no small print and no nasty surprises. What you see is what you get.

Our loans have been designed to provide quick, clear and fair finance for people who need help making ends meet.

Moni Market Financial Services Limited is a registered company operating within PNG.

The Credit Agreement (Loan Agreement) will be governed by the laws of PNG.

- Establishment Fee – K25

- K28 extension fee should you require additional time to repay

- Interest is charged at 25%, 40%, per day on the outstanding balance of the loan based on the original loan size

- K30 wage deduction fee if you fail to repay your loan

- K20 default fee if you fail to make your payment

We will get in touch with you if any of your payments dishonour and if you have a genuine reason we will do everything we can to help you. If you are able to make the payment within 36 hours we will not charge a default fee of K20.

If we have not been able to come to some agreement after ten days, or you have dishonoured more than once, we will arrange to recover the loan by wage deduction.

If we still have not been paid in full we will lodge a default against your credit report, this may be followed by legal action.

If you have experienced some form of hardship e.g. sickness, redundancy, family bereavement—between taking your loan and your payment we will look to put a new schedule together without adding additional fees.

If you fail to repay your loan it will negatively affect your credit rating.

Moni Market loans are only suitable to improve short term cash flow requirements.

Any advice provided is generic in nature and may not suit your individual needs. If you are already in debt we would advise you to seek professional budgeting advice before taking out a Moni Market loan.

If you have any questions about our loan, or do not understand what you are signing you should seek independent legal advice.